Bookkeeping is the systematic process of recording, organizing, and maintaining a business's daily financial

transactions, like sales, purchases, receipts, and payments, forming the foundation for financial reporting

and decision-making. It involves tasks such as journal entries, bank reconciliations, and managing accounts

payable/receivable, providing crucial data for understanding a company's financial health, ensuring tax

compliance, and enabling strategic financial planning.

Bookkeeping is the systematic process of recording, organizing, and maintaining a business's daily financial

transactions, like sales, purchases, receipts, and payments, forming the foundation for financial reporting

and decision-making. It involves tasks such as journal entries, bank reconciliations, and managing accounts

payable/receivable, providing crucial data for understanding a company's financial health, ensuring tax

compliance, and enabling strategic financial planning.

* Tracks Financial Health: Gives a clear picture of

income, expenses, assets, and liabilities.

* Informs Decisions: Data helps in setting budgets,

making investments, and planning for growth.

* Ensures Compliance: Keeps records organized for

taxes and adherence to accounting principles (like GAAP).

* Separates Finances: Crucial for separating personal

and business funds, reducing liability.

* Identifies Errors: Helps catch mistakes early, preventing

bigger financial issues.

We specialize in bookkeeping for 'Goods and Services' businesses by recording, organizing, and tracking your business's financial transactions, such as income, expenses, and liabilities, to provide a clear financial picture and ensure legal compliance. Key tasks include recording sales and receipts, managing accounts receivable (money owed to the business), and preparing basic financial statements like a balance sheet and profit and loss (P&L) account.

Accounting data entry involves the process of inputting, updating, and managing financial information into accounting systems. This crucial task ensures the accuracy and integrity of financial records, supporting informed decision-making within a business.

General ledger (GL) maintenance involves regularly updating, reconciling, and cleaning your business's core financial records to ensure accuracy, completeness, and compliance, using processes like monthly reconciliations, proper categorization, removing unused accounts, documenting procedures, and performing periodic audits. Key activities include posting transactions, reconciling GL balances with bank statements, correcting errors, standardizing your Chart of Accounts, and ensuring audit trails are in place.

Comparing and adjusting the balance of a company's cash account as recorded in its books with the balance reported by the bank on its bank statement. This ensures that the company's financial records accurately reflect its cash position. It involves identifying and correcting any discrepancies between the two balances.

A formal request for payment that outlines the details of the transaction, including what was purchased, the quantity, the price, and the due date. Effective invoicing is crucial for businesses to get paid on time and maintain healthy cash flow.

Accounts receivable (AR) management is the process a business uses to track, manage, and collect payments owed by customers for goods or services sold on credit. Effective AR manage-ment is crucial for maintaining a healthy cash flow, minimizing bad debts, and fostering positive customer relationships.

Accounts payable (AP) management is the process of overseeing a company's outstanding debts to vendors for goods or services purchased on credit. It involves tracking, processing, and paying invoices while maintaining accurate records and positive supplier relationships. Effective AP management is crucial for maintaining financial health, controlling cash flow, and avoiding late fees.

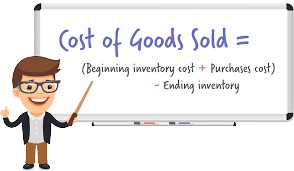

Inventory accounting is a specialized area of accounting that focuses on recording, tracking, and valuing a company's inventory, which includes raw materials, work-in-progress, finished goods, and supplies needed for maintenance, repair, and operations. It plays a crucial role in determining a business's financial health, impacting profitability, taxation, and operational efficiency.

Financial statements are formal records that provide an overview of a company's financial activities and position. They offer insights into a business' performance and health, making them essential tools for various stakeholders, including investors, lenders, and management. Financial statements are often audited to ensure accuracy for tax, financing, or investing purposes.

Copyright © 2025 - Prosperity Small Business Bookkeeping Services. All rights reserved.